Parties

Provide the parties relating to the customs declaration under “Parties”. You can provide details of the following parties: submitter, declarant, declarant’s representative, importer, exporter, buyer, seller and other trader (e.g. the party responsible for VAT).

The field “Email address for notifications” is filled in automatically if you have given your consent for electronic notice of decisions. Do not remove the consent. If you wish to change your consent for electronic notice, do it under “Settings”. For detailed guidance, see Settings – Customs instructions.

You should also provide here the number of the authorisation for simplification, if you already have an authorisation granted by the Customs Authorisation Centre.

.png/5cd555e5-a8a8-0316-3830-9b2bde9e4b1b?t=1716560559278)

General information about providing the trader identifier

Every party in the declaration must have an identification number, either an EORI number or some other unique identifier.

The EORI number is mandatory for the importer, the declarant and the representative when they are businesses. Foreign businesses must also provide the EORI number. If a business’s identification number does not have the EORI number status, the import declaration will be rejected. You can check the validity of the company’s EORI number in the Commission’s EORI number validation service. Apply for the EORI registration from Customs in advance, if you need it.

The EORI number doesn’t need to be provided as the identifier for other traders (e.g. exporter, buyer, seller). Private individuals usually don’t need to have an EORI number either. In such cases, provide one of the following identification numbers:

- Finnish traders: the Business ID

- foreign traders: the VAT number

- Finnish individuals: the country code, the personal identity code

- foreign individuals: the country code, the date of birth (e.g. US25071980).

Please note: do not include spaces in the identification number. Write e.g. the numbers immediately after the country code. In addition to the identification number, provide the trader’s name and address.

In addition to the identification number, you can also provide the trader office code issued by Customs. A representative must always provide their trader office code. If you provide the trader office code in the declaration, the service automatically completes, in the declaration details to be archived by Customs, the address details already entered in Customs’ customer register on the basis of earlier authorisation details. You can check your trader office code in our “My details” service.

Under “Declarant”, “Representative” and “Importer”, some of the details will be displayed automatically when you tick the box “Use the details of the authenticated trader”. The address details according to the trader office will then be completed in the declaration. As default, the address of the business’s head office according to the BIS is displayed as the trader office address details (trader office code “000”).

The periodic filing, i.e. the consolidated invoice, will also be sent to the address according to the trader office code you have provided, if the you have a payment deferment authorisation and you haven’t provided any e-invoicing address under additional information in the declaration.

Contact person

The contact person is the submitter of the declaration. Customs may contact the contact the contact person for further information.

If you have saved your details in advance in the settings, you can tick the box “Use the details of the authenticated person”, and the field for trader office code will be completed automatically in the declaration. If you’re not using the details of the authenticated trader, enter your name, email address and phone number in the fields.

Declarant

The declarant is responsible for placing the goods under the procedure and for the accuracy of the declaration. The importer is usually entered as the declarant. In the case of indirect representation, the representative is entered as the declarant.

If you tick the box “Use the details of the authenticated trader” and you have saved the trader office code in advance in the settings, the field for trader office code will be completed automatically in the declaration.

If you’re not using the details of the authenticated trader, provide an EORI number or a private individual’s personal identity code as the identification number. If the identification number is an EORI number, the service will automatically complete the fields for name and address details as well as trader nature. Otherwise, enter the name, street address, postal code, city, country, trader nature and transaction language. Select the trader nature and transaction language from the drop-down menu.

If you are completing the declaration as a representative, enter the importer’s identification number under “Declarant”. The identification number of a business is the EORI number and a private individual’s identification number is made up of the country code FI and the personal identity code. If the individual doesn’t have a Finnish personal identity code, enter the country code and the date of birth. The date of birth is entered in the format dd.mm.yyyy.

For a Finnish business, select “Y – Company/Finland” as the trader nature. Select “EORI” as trader nature only if the trader is a business established outside the EU, with an EORI number issued by Finland.

If a foreign importer (e.g. a foreign corporation or a subsidiary of a foreign business) has both a Finnish Business ID for value added taxation and an EORI number not issued by Finland, provide the EORI number as the identification number under “Declarant”. Provide the Finnish Business ID later under “Additional fiscal traders” by entering the role “FR1 – Importer”.

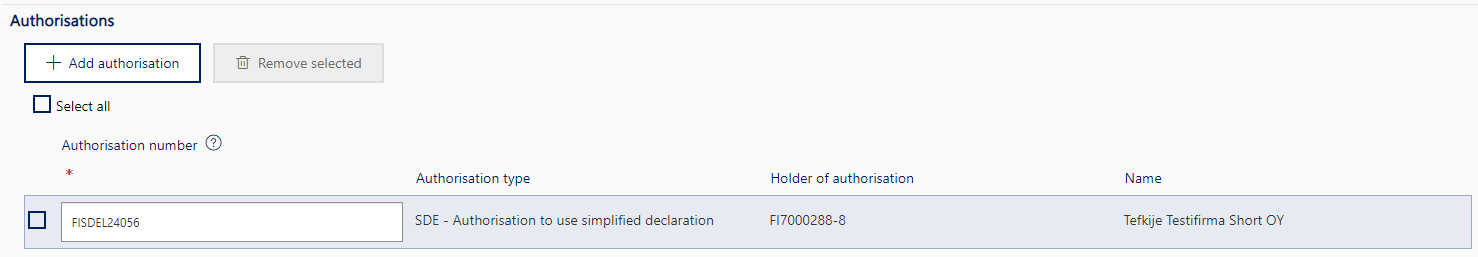

Authorisations: Details of a written authorisation granted by Customs

When you use a simplified customs declaration, the written authorisation has usually been applied for in advance from the Customs Authorisation Centre. Enter the details of the written authorisation here, under “Authorisations”.

Enter the authorisation number in the column “Authorisation number”. When you enter the authorisation number, the service will automatically complete the details in the columns “Authorisation type”, “Holder of authorisation” and “Name”. Some of the authorisation details will be displayed in the customs clearance decision.

If you are lodging a declaration for the customs procedure 61 and you have an outward processing authorisation, don’t provide it here. Provide it later at goods item level as an additional document using the code “C019 – OPO – Authorisation for the use of outward processing procedure (Column 8b, Annex A of Delegated Regulation (EU) 2015/2446)”.

If you want to remove an authorisation that has been provided incorrectly, tick the box in front of the authorisation number column. Then click on the button “Remove selected”.

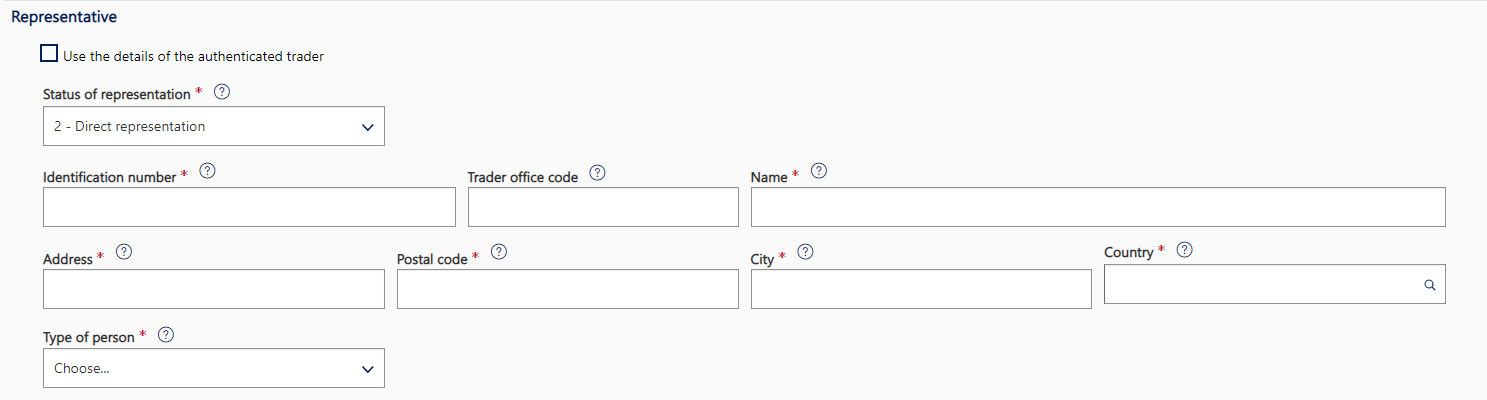

Representative

If you are lodging the declaration as a representative on the importer’s behalf, add your details under “Representative” by clicking on the button “+Add representative” A forwarding agency, for example, can act as a representative. The representative must always have an EORI number.

If you have saved your details in advance in the settings, you can tick the box “Use the details of the authenticated trader”, and the trader office code will be filled in automatically in the declaration. If you’re not using the details of the authenticated trader, enter the identification number in the declaration. If the identification number is an EORI number, the service will automatically complete the fields for name and address details as well as trader nature. Otherwise, enter the name, street address, postal code and city and select the country and the trader nature from the drop-down menu.

Select the status of representation from the drop-down menu. It can be direct representation, indirect representation or direct representation on guarantor’s responsibility. If you use direct representation on guarantor’s responsibility, select “2 – Direct representation” from the drop-down menu and tick the box “On guarantor’s responsibility”.

Direct representation: A direct representative lodges the customs declaration on behalf of and in the name of the importer. The importer is responsible for the correctness of the information provided. The importer’s guarantee is used in the declaration, and the importer is responsible for the customs debt. The representative is responsible for the customs debt only insofar as they were aware or should have been aware of the incorrectness of information provided in the customs declaration.

Indirect representation: The customs declaration is lodged in the name of the representative but on behalf of the importer. An indirect representative is also responsible for the correctness of the information provided in the declaration. The representative’s guarantee is used in the declaration, and the representative is responsible for the customs debt. However, in addition to the indirect representative, the importer is also always responsible for the customs debt. The representative must also be the authorisation holder, and the authorisation must be applied for in advance.

Direct representation on guarantor’s responsibility The customs declaration is lodged in the name of and on behalf of the importer. The representative is responsible for the customs debt only insofar as they were aware or should have been aware of the incorrectness of information provided in the customs declaration. The representative’s guarantee is used in the declaration, and the representative commits to paying the customs debt up to the amount of the guarantee.

Importer

The importer must always be provided. The importer is a business or person that has originally agreed on the import of the goods and is therefore the consignee of the goods.

If you have saved your details in advance in the settings and you are not using a representative, you can tick the box “Use the details of the authenticated trader”. The service will then automatically complete your details in the declaration under “Importer”. Otherwise, enter the importer’s identification number, name, street address, postal code, city, country and trader nature. The trader nature is selected from the drop-down menu.

For an importer established within the EU, always provide the EORI number issued by the importer’s own country as the identification number.

Exporter

The exporter is the last seller of the goods before the import of the goods into the customs or fiscal territory of the EU.

Additional AEO supply chain actors

Select the trader role for an additional AEO supply chain actor. Provide the additional AEO actor’s identification number and trader office code.

Additional fiscal traders

Add an additional fiscal trader by clicking on “+ Add trader” in the following cases:

- You use the customs procedure 42 or 63 and the VAT is paid to another Member State, although the customs declaration is lodged in Finland. Select the role “FR2 – Customer” and, as the identification number, provide the VAT number issued by the Member State where the transport ends. If the importer is a foreign business with a VAT number issued by Finland, select also the role “FR1 – Importer” and provide that VAT number as the identification number.

- You are lodging a declaration where the VAT is declared by the IOSS registered seller itself. As the role, select “FR5 – Vendor (IOSS)” and provide the identification number you received from the seller.

- You are lodging a declaration where a foreign importer has a VAT number issued by Finland. Select the role “FR1 – Importer” and provide that VAT number as the identification number.