- Tullin ohjeet

- en

- Import

- Intra-EU tax border declaration

- Goods item

Goods item

Under one goods item, provide the goods with the same commodity code, goods description, previous procedure, additional procedure and country of origin. If there are e.g. several commodity codes, provide them as separate goods items.

The goods item details include

- procedure details

- goods item-specific unique consignment reference

- commodity code and description of goods

- TARIC information

- packages

- previous documents

- additional information codes

- additional documents, if any

- container details, if any

- net mass and possible supplementary unit

- value information of the goods

- preference.

Commodity code and basic information

Provide here the required basic information about the goods item. Read the detailed guidance below.

Requested procedure

Based on the declaration type you have chosen, the service automatically fills in “40 – Release for free circulation” or “61 – Re-importation with simultaneous release for free circulation and home use of goods” as the procedure. If you notice that it should be some other customs procedure (such as inward processing or temporary admission), you’ll have to start lodging the declaration all over again.

Previous procedure

Select the code for the customs procedure preceding the declaration from the drop-down menu.

If the goods don’t have any previous customs procedure (e.g. the goods are in temporary storage), choose the code “00”.

If the previous customs procedure was transit, provide the procedure that preceded transit. However, provide the reference number of the transit declaration as the previous document.

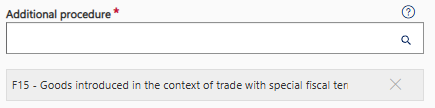

Additional procedure

Based on you earlier choices, the service automatically fills in “F15”, required in tax border declarations, as the additional procedure.

You can add other additional procedures, if needed.

Choose one or more than one additional procedure for the goods from the drop-down menu. Provide all the required additional procedure codes.

If there is no additional procedure in the declaration, choose “999 – No additional procedure”. The additional procedure is saved when you have chosen it from the list.

After you have chosen an additional procedure, the menu opens again and you can make more choices. If you do not need to choose another additional procedure, go to the next section.

You can remove the additional procedure by clicking on the cross (X) next to the procedure.

Reference number (UCR)

This field can usually be left blank. Complete the field only if the consignor has issued a UCR (Unique Consignment Reference), which remains the same throughout the supply chain. It can be a WCO (ISO 15459) code or some other similar code.

Commodity code

Provide the 8-digit commodity code of the goods. Read more about commodity codes on the Customs website.

Description of goods

Under “Description of goods”, provide the common trade name based on which the goods can be identified. You can’t use a general name describing the goods or just the model or product number. The goods description must be a verbal description of the goods.

For example, “clothes” is not sufficient – you have to specify what kind of clothes they are, such as “women’s nightdresses of cotton”. The description “spare parts” is not sufficient – you have to specify what kind of spare parts they are, e.g. “car windshield” or “fanbelt”.

TARIC information

Provide here the required information about the TARIC additional codes and national additional codes. Read the detailed guidance below.

.png/92219bb7-4def-b960-6451-5a48645a4077?t=1768309693428)

TARIC additional codes

If the commodity code is subject to restrictions, indicate the restrictions that apply by selecting the correct TARIC additional codes.

National additional codes

Select the VAT rate of the goods as the national additional code.

CUS code

The CUS code is a European identifier relating to exports and imports of dangerous chemicals. Check e.g. in the TARIC database, whether there is a CUS code for the commodity code that requires measures. If yes, provide the CUS code here. Please note that if you provide the CUS code, you still have to provide the goods description. Read more about the CUS codes on the website of the European Chemicals agency.

Packages

Provide the package details. A package refers to a unit that can’t be divided without first undoing the packing.

From the drop-down menu in the field “Kind of packages”, select the code that indicates the kind of packages.

In the field “Number of packages”, enter the number of invidual packages. If the goods are unpacked, provide the number of items. This information doesn’t need to be provided where goods are in bulk. If a package contains several goods items, enter one (1) as the number of packages in the details of at least one of the goods items. In the details of the other goods items in the same package, enter zero (0) as the number of packages.

In the field “Shipping marks”, provide a free-form description of the marks and numbers on packages. If the packages are not marked, enter “No markings”. If you have entered zero as the number of packages, provide the same package markings as on the goods item for which the total number of packages has been provided. If there are several kinds of packages for the goods, provide them on separate rows. A new row will be displayed when you click on ”+Add package”.

If you are importing grid electricity from Sweden to Åland, provide ”NE - Unpacked or unpackaged” as the kind of packages and “1” as the number of packages.

Previous documents

.png/7f1e9f22-b05b-e074-8412-c9a96818c61f?t=1693386851307)

If you are lodging the declaration the day when the goods arrive and there is no previous document for the consignment, this detail is not provided. If you have added an empty row by mistake by clicking on “+ Add document”, remove the row by ticking the box next to the row and clicking on “Remove selected” above the rows.

Provide the previous document, if there is e.g. a previous transit declaration for the consignment.

If you are pre-lodging a declaration or if you are lodging a periodic declaration of a VAT-registered importer, provide “1ZZZ – Other previous document” as the previous document type and, as the reference, e.g. the number of the consignment note or of another document related to the delivery of the goods.

If the previous declaration was lodged under a fallback procedure, and no MRN was issued to the fallback procedure, select “1ZZZ – Other previous document” as the previous document type. Choose the previous document type from the drop-down menu of the first column “Previous document type”. Also provide the reference. You don’t need to provide the item number or the transport document identifier.

If you are lodging a periodic declaration and you know the MRN in the notice of arrival submitted by the transport company, provide it here. Select “NMRN – Declaration/notification MRN” as the previous document type.

Also provide the transport document identifier, if the previous document is “N337 – Temporary storage declaration”.

Additional information

If you need to provide additional information on the goods item, you can add it by clicking on “+Add information”. Select the additional information code in the drop-down menu for the field “Code”. Provide the information that the additional information code requires in the field “Description”. You can select more than one additional information code, if necessary.

Additional documents

You can add an additional document by clicking on “+Add document”. Fill in at least the columns “Type” and “Identifier”.

.png/7337646f-9950-c5b2-5f6a-8b4d08ddc1e4?t=1667990324227)

You don’t need to upload the additional document, unless Customs specifically asks for it. If you want to upload a document as an attachment, click on “Upload file”. The supported attachment file types are PDF, JPG, PNG and TIF. The maximum attachment size is 5 MB. When you have uploaded the attachment, the service displays the column for the attachment reference with the reference number issued by Customs.

If you are lodging a periodic declaration of a VAT-registered importer and provide the additional documents at goods item level, provide the numbers of the invoices for the imports during the period, the transport document numbers or some other document for identification of the goods.In the records, you can also compile a list of the documents related to the different consignments, and provide the name and date of the compiled list as the identification number of the additional document.

The “Additional information about attachment” button is not used.

Transport documents

Type: Here you can provide e.g. the details of the consignment note related to the goods item.

Reference: If you provided e.g. the consignment note related to the goods item in the field “Type”, provide its reference number here.

Additional references

The field has been filled in based on your earlier choices.

Container

The container details can be provided either at header level under “Declaration header” or at goods item level here. So if the goods are in a container and you have not provided the container details at declaration header level, provide the container details here. If the goods are in a container when you are lodging the declaration, provide the identification numbers for a sea container, swap body, semi-trailer or an air transport intermodal container. The identification of a sea container is provided using four letters + six digits + hyphen + check digit.

Quantity information of the goods

Provide here the required quantity information of the goods. Read the detailed guidance below.

Net mass

Net mass is the actual weight of the goods without any packaging. If you are importing grid electricity from Sweden to Åland, provide 1 kg as the net mass.

Supplementary units

If the TARIC nomenclature requires a supplementary unit for the commodity code, it will be displayed in the service. Enter the supplementary unit under “Quantity”. For example, many commodity codes for clothes require “piece” (NAR) as supplementary unit.

Value details of the goods

The value information provided at goods item level includes statistical value, transaction price as well as items to be added to or deducted from the transaction price that affect the customs value or the taxable amount for VAT. Items to be added can be e.g. freight and insurance costs.

The service automatically asks for the statistical value and te transaction price. If you wish to provide items to be added to or deducted from the transaction price, add a row by clicking on “+ Add”. The select from the drop-down menu, the item to be added or deducted.

Read the detailed guidance below.

.png/5e5888be-6fb0-ce87-7bc9-0cf98d654b12?t=1693387066242)

Statistical value

Provide the statistical value of the goods in euros. Statistical value refers to the value of the goods on their arrival in Finland. It includes the actual or, if needed, the calculated transport and insurance costs as well as, if needed, the free deliveries not included in the price. The statistical value must be provided, even if nothing has been paid for the goods.

Transaction price

The transaction price is the amount actually paid or payable for the goods, while taking into account all discounts (cash, quantity or other discounts) that are acceptable when determining the customs value.

Provide the transaction price with two decimals in the currency indicated in the invoice. If the transaction price is not available when a declaration is lodged, it can be provided using the estimated details available at that time.

Items to be added to or deducted from the value of the goods

If the importer of the goods isn’t registered for VAT, provide any costs (e.g. transport costs) to be added to or deducted from the price paid or payable for the goods in order to determine the taxable amount for VAT for the goods.

Click on “+Add”, and a new value row will be displayed. From the dropdown menu, select the code of the item to be added or deducted. For example, select the code “3A” for transport, unloading and other costs to be included in the taxable amount for VAT. For more information about the costs to be included in the taxable amount for VAT, go the Tax Administration website.

If you are registered for VAT, you must provide the VAT details and the taxable amount for VAT in the Tax Administration’s MyTax service. In that case, the details that only affect the levy of VAT need not be provided in the customs declaration. This means that e.g. transport and other costs paid separately for transporting the goods from Sweden to Finland don’t need to be provided in the customs declaration. If you wish, you can still provide such costs as an item to be added also in the customs declaration. In such cases, use the code “1A – Total to be added”, although the customs value is not actually calculated for imports of Union goods.

Currency

Provide the currency codes for the transaction price as well as for any costs to be added or deducted.

If the currency you need can’t be found in the drop down menu, you need to request the currency conversion rate from the Customs Information. You should convert the transaction price into euros using the currency conversion rate that you received from Customs. Enter the transaction price in euros. In addition, at goods item level, provide the currency conversion rate that you received with additional information code “FIKUR” and enter as the description the received conversion rate and the currency code (i.e. “19.14 MDL”).

VAT

The section “VAT” is only displayed if the importer isn’t registered for VAT.

Select the correct VAT rate from the drop-down menu. The general VAT rate is 25,5%, but e.g. for newspapers and periodicals it is 10% and for books, medicines, art items and foodstuffs 13,5%.

The VAT rate must be provided regardless of whether the VAT is levied by Finnish Customs or by the Finnish Tax Administration. It is possible to change the VAT rate later also under "National additional code".

Valuation indicators

Valuation indicators are not provided in tax border declarations.

Preference and quota

Select the preference code “100 – Tariff arrangement erga omnes” from the dropdown menu.

Tax bases

“Tax bases” are not provided in tax border declarations.

Additional references of documents and certificates

“Additional references of documents and certificates” are not provided in tax border declarations.

Moving on from the goods item details

When you have entered all the details of the goods item, you can add another goods item by clicking on “+Add goods item” at the bottom of the page.

If you aren’t going to add any goods items, you can view the summary of the declaration you have filled in. Click on “Next” to proceed to the section “Summary and submission”.