Goods item

Under one goods item, provide the goods with the same commodity code, goods description, previous procedure, additional procedure and country of origin. If there are e.g. several commodity codes, provide them as separate goods items.

The goods item details include

- procedure details

- countries of origin

- goods item-specific unique consignment reference

- commodity code and description of goods

- TARIC additional code(s), national additional code(s) and other restriction-related details of the commodity code

- gross mass and net mass and possible supplementary unit

- value information of the goods

- preferential treatment, quota and taxable amounts

- packages

- previous documents

- additional information codes

- additional documents, if any, and other reference data relating to the customs clearance

- container details, if any.

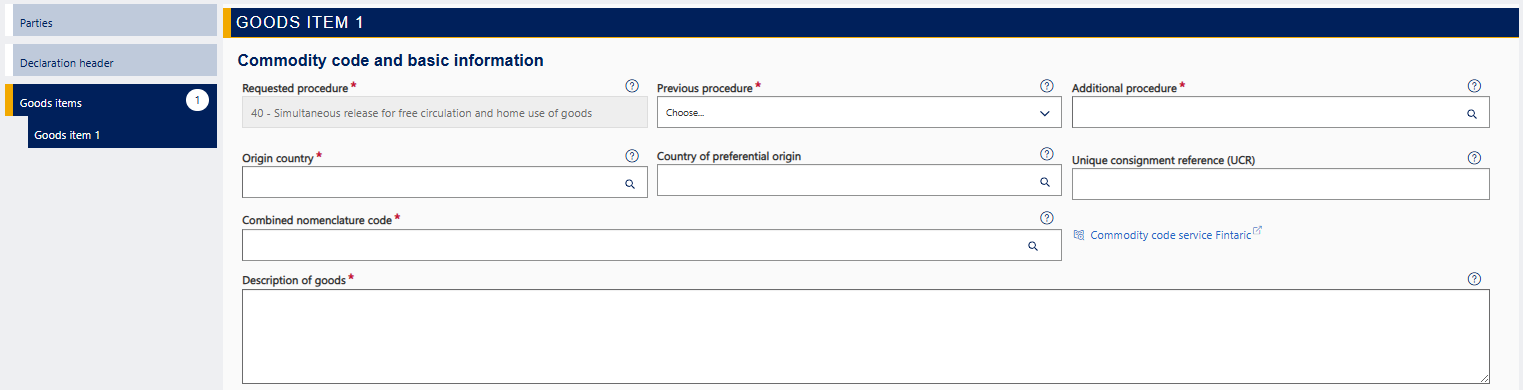

Commodity code and basic information

Provide here the required basic information about the goods item. Read the detailed guidance below.

Requested procedure

The service fills in the requested customs procedure based on your earlier choices. The service will display the customs procedure you chose when you started lodging the declaration. If the customs procedure is incorrect, you’ll have to start lodging the declaration all over again.

Previous procedure

Select the code for the customs procedure preceding the declaration from the drop-down menu. Select the code “00”, if there is no previous procedure for the goods (e.g. the goods are in temporary storage or they arrive under a transit procedure without having been placed under another customs procedure before that).

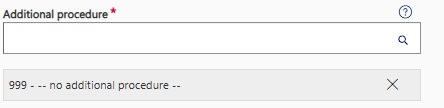

Additional procedure

Choose one or more than one additional procedure for the goods from the drop-down menu. Provide all the required additional procedure codes.

If there is no additional procedure in the declaration, choose “999 – No additional procedure”. The additional procedure is saved when you have chosen it from the list.

After you have chosen an additional procedure, the menu opens again and you can make more choices. If you do not need to choose another additional procedure, go to the next section.

You can remove the additional procedure by clicking on the cross (X) next to the procedure.

Origin country

Select the country code for the country of origin of the goods according to the general rules of origin. What restrictions to provide depends on the country of origin and the commodity code. If you do not know the country of origin, provide the country of dispatch. You can find the code for the country of origin from the dropdown menu by typing the beginning of the country name or code in the field or by using the search function, which will open a dropdown list.

If you are lodging a supplementary customs declaration, provide the same country of origin as in the previous document.

Country or country group of preferential origin

If you are applying for preferential treatment with the customs declaration, provide the country or country group of preferential origin. By doing so, you can obtain a lower customs duty or duty-free treatment. You can find the code for the country or country group of origin from the drop-down menu by typing the beginning of the name of the country or country group or the beginning of the code in the field or by using the search function. Also remember to provide the preference code for the country or country group later under “Preference”.

If you are lodging a supplementary customs declaration, provide the same country or country group of origin as in the previous document.

Unique consignment reference (UCR)

This field can usually be left blank. Complete the field only if the consignor has issued a UCR (Unique Consignment Reference), which remains the same throughout the supply chain. It can be a WCO (ISO 15459) code or some other similar code.

Commodity code

Provide the 10-digit commodity codes of the goods.

If you have a BTI decision for the goods to be imported, you must use the commodity code indicated in the decision. Later, under “Additional documents”, you shall also provide “C626 – BTI - Decision relating to Binding Tariff Information (Column 1a, Annex A of Delegated Regulation (EU) 2015/2446)” as the type and the reference number of the decision as its identifier.

Ifyou don’t know the commodity code, you can look it up in the commodity code service Fintaric or the TARIC database or ask the Customs Information Service. You can also go to the commodity code service Fintaric by clicking on the link displayed in the service. If the commodity code you have chosen is subject to restrictions or national additional codes, they will be displayed under “TARIC information”. Read more about commodity codes on the Customs website.

Description of goods

Under “Description of goods”, provide the common trade name based on which the goods can be identified. You can’t use a general name describing the goods or just the model or product number. The goods description must be a verbal description of the goods.

For example, “clothes” is not sufficient – you have to specify what kind of clothes they are, such as “women’s nightdresses of cotton”. The description “spare parts” is not sufficient – you have to specify what kind of spare parts they are, e.g. “car windshield” or “fanbelt”.

Certificates

The goods may be subject to several restrictions and related certificates. The certificates are displayed automatically in the service based on the origin and commodity code you provided earlier. For each of them, you must either tick the box next to the certificate or leave it unticked.

If, for example, you are providing the commodity code for peaked caps in the field “Combined nomenclature code” and your peaked caps are not seal products, select condition code “Y032” – “Other goods than those seal products mentioned in Regulation (EU) 2015/1850 (OJ L 271)” from the alternatives displayed. If your peaked caps are seal products, select the appropriate certificate.

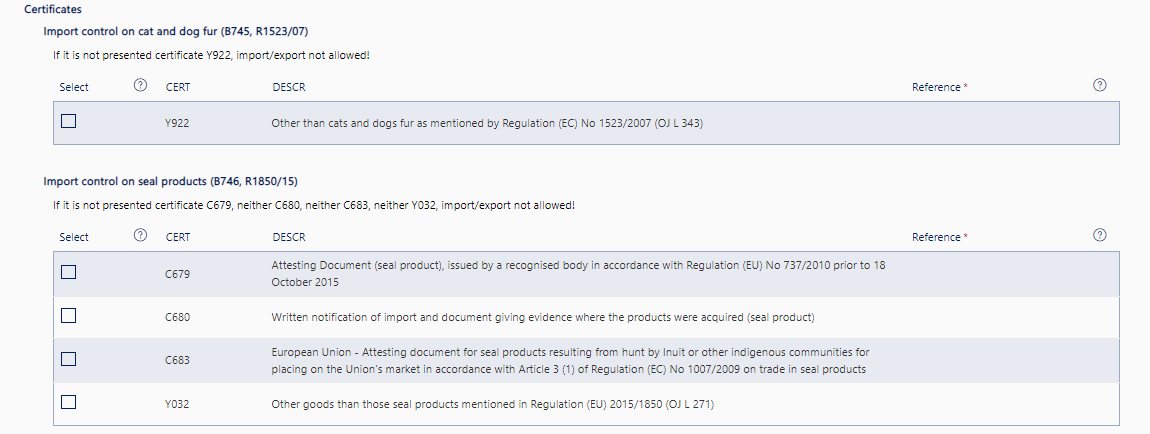

TARIC information

Provide here the required information about the TARIC additional codes and national additional codes. Read the detailed guidance below.

TARIC additional codes

The TARIC additional code can be used to indicate restrictions on goods or additional information affecting taxation. Additional information that affects taxation may be e.g. that a company-specific anti-dumping duty is going to be requested on the goods. The TARIC additional code to be provided in the customs declaration is always a four-character code.

You can find the TARIC additional code for the goods e.g. in the Fintaric service. If the commodity code is subject to restrictions, indicate the restrictions that apply by selecting the correct TARIC additional codes.

National additional codes

National additional codes include the VAT rate codes beginning with Q and the codes beginning with V related to excise products. Provide the national additional codes if the service requires them.

You can choose the VAT rate later, under “Value information of the goods”. The general VAT rate is 25,5%, but e.g. for newspapers and periodicals it is 10% and for books, medicines, art items and foodstuffs 13,5%.

The VAT rate must be provided regardless of whether the VAT is levied by Finnish Customs or by the Finnish Tax Administration.

If you are lodging a supplementary customs declaration, provide the same naional additional code as in the previous document.

CUS code

The CUS code is a European identifier relating to exports and imports of dangerous chemicals. Check e.g. in the TARIC database, whether there is a CUS code for the commodity code that requires measures. If yes, provide the CUS code here. Please note that if you provide the CUS code, you still have to provide the goods description. Read more about the CUS codes on the website of European Chemicals agency.

Packages

Provide the package details. A package refers to a unit that can’t be divided without first undoing the packing.

From the drop-down menu in the field “Kind of packages”, select the code that indicates the kind of packages.

In the field “Number of packages”, enter the number of invidual packages. If the goods are unpacked, provide the number of items. This information doesn’t need to be provided where goods are in bulk. If a package contains several goods items, enter one (1) as the number of packages in the details of at least one of the goods items. In the details of the other goods items in the same package, enter zero (0) as the number of packages.

In the field “Shipping marks”, provide a free-form description of the marks and numbers on packages. If the packages are not marked, enter “No markings”. If you have entered zero as the number of packages, provide the same package markings as on the goods item for which the total number of packages has been provided.

If there are several kinds of packages for the goods, provide them on separate rows. A new row will be displayed when you click on ”+Add package”.

If you are lodging a supplementary declaration for one simplified declaration or presentation notification, the kind of packages and the number of packages must be the same as in the simplified declaration or presentation notification.

If you are lodging a supplementary periodic declaration, provide the details of the packages that arrived during the period by goods item and kind of packages.

Previous documents

Provide the previous document. It is usually an entry summary declaration, temporary storage declaration, i.e. summary declaration, or a T1 transit declaration.

.png/f27fd404-bde5-9d4b-7179-406beef91549?t=1693372652781)

Choose the previous document type from the drop-down menu of the first column “Previous document type”. Select the type as follows:

- If the transport company has provided the MRN as the previous document, select either “N355 – Entry summary declaration” or “N337 – Temporary storage declaration” as the previous document type.

- If the goods arrive under the transit procedure, select “N821 – External Union/common transit declaration (T1)” as the previous document type and the transit MRN as the reference.

- If the goods arrive under the T2 or T2F transit procedure or if the transit contains both T1 and T2 goods (so-called mixed consignments), select “1ZZZ – Other previous document” as the previous document type.

- If the country of dispatch is Norway and there is no previous document, this detail is not provided.

- If no transit declaration has been submitted for a consignment arriving from Norway, the previous document is not provided in the customs declaration.

- If the previous declaration is an electronic import or customs warehousing declaration submitted to the Customs Clearance System or through message exchange, provide “NMRN – Declaration/notification MRN” as the previous document type and the MRN as the reference.

- If the previous declaration was lodged under a fallback procedure, and no MRN was issued to the fallback procedure, select “1ZZZ – Other previous document” as the document type.

- If goods are re-imported, and “21 – Re-export” is provided as the previous procedure, select, despite this, “N355 – Entry summary declaration”, “N337 – Temporary storage declaration” or “N821 – External Union/common transit declaration (T1)” as the previous document type.

- If the previous procedure is “51 – Inward processing”, provide one of the following as the previous document type:.

- If the goods are imported after the inward processing procedure under the transit procedure to be released for free circulation, provide the transit declaration as the previous document. Provide “N821 – External Union/common transit declaration (T1)” as the previous document code.

- If you provide the arrival ID of a postal consignment when you are selecting the declaration, the previous document details will be filled in automatically based on the information provided by the transport company.

- Read more on the page “Inward processing” on the Finnish Customs website.

- If you are lodging a supplementary declaration for one simplified declaration or presentation notification, the previous document details will be filled in automatically.

- If you are lodging a supplementary periodic customs declaration, the previous documents will be filled in automatically based on the declarations you have chosen earlier. They will be displayed at declaration header level. Leave this section blank.

- If the goods arrive by post or express freight and you have provided the arrival ID earlier, the details of the previous document will be filled in automatically. The transport document identifier will be filled in based on the information provided by the transport company.

- If the previous procedure is “53 – Temporary admission”, provide one of the following as the previous document type:

- If the goods are imported after the temporary admission procedure under the transit procedure to be released for free circulation, provide the transit declaration as the previous document. Provide “N821 – External Union/common transit declaration (T1)” as the previous document code.

- If you provide the arrival ID of a postal consignment when you are selecting the declaration, the previous document details will be filled in automatically based on the information provided by the transport company.

- Read more on the page “Temporary admission” on the Finnish Customs website.

- If the previous procedure is temporary admission for which a customs declaration has been lodged by a factual act or orally (the form 613 has been submitted as a supporting document to the oral declaration), provide “1ZZZ – Other previous document” as the previous document type and, as the reference, e.g. the explanation “driving it oneself”.

If you use the MRN as reference, provide the related sequence number of the goods item in the column “Item number”. Regarding transit declarations, the goods item number need not be provided.

Also provide the transport document identifier, if the previous document is “N355 – Entry summary declaration” submitted to the Commission’s ICS2 system or if the previous document is “N337 – Temporary storage declaration”.

Additional information

If you need to provide additional information on the goods item, you can add it by clicking on “+Add information”. Select the additional information code in the drop-down menu for the field “Code”. Provide the information that the additional information code requires in the field “Description”. You can select more than one additional information code, if necessary.

If you are declaring a vehicle, select the code “FIXBC – Vehicle production number” and provide the production number in the column “Description”.

Additional documents

You can add an additional document by clicking on “+Add document”. Fill in at least the columns “Type” and “Identifier”.

.png/96e751e4-7855-ff8d-2fae-e10720837f5b?t=1667894608165)

You don’t need to upload the document as an attachment to the declaration, unless Customs specifically asks for it. You can speed up the processing of the declaration by uploading the document already when filling in the declaration. If you are lodging a customs declaration for inward processing, temporary admission or end-use, Customs usually asks you to send an invoice or some other document indicating the value as the attachment. If you are lodging a declaration for re-import after outward processing (6121), provide the outward processing authorisation as an additional document using the code “C019 – OPO – Authorisation for the use of outward processing procedure (Column 8b, Annex A of Delegated Regulation (EU) 2015/2446)”.

Type: Here you can provide e.g. the details of the consignment note related to the goods item.

Reference: If you provided e.g. the consignment note related to the goods item in the field “Type”, provide its reference number here.

If you want to upload a document as an attachment, click on “Upload file”. The supported attachment file types are PDF, JPG, PNG and TIF. The maximum attachment size is 5 MB. When you have uploaded the attachment, the service displays the column for the attachment reference with the reference number issued by Customs.

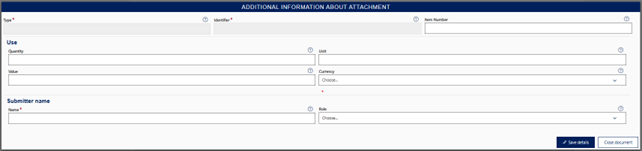

You don’t need to provide additional information about the attachment, if your declaration doesn’t require that an authorisation or a certificate be provided (e.g. an entry document submitted to the TRACES system). Provide the additional information by clicking on “Additional information about attachment”, which opens a pop-up window. If you are providing details of an entry document you submitted to the TRACES system, fill in the entry document item number in the field “Item Number” (e.g. “1”, if the goods are on the first row in the entry document). Don’t fill in any other fields in the pop-up window. Provide the quantity and unit of the goods item, if providing the restriction so requires. For declaration guidance, check the pages about providing restrictions on our website. Provide the value and currency of the goods item, if providing the restriction so requires. For declaration guidance, check the pages about providing restrictions on our website.

In the field “Type”, you can provide e.g. the details of the invoice related to the goods item.

In the field “Identifier”, you should provide the reference number of the document you provided in the field “Type”. The reference number can be e.g. the number of the invoice related to the goods item.

Additional information about attachment (pop-up window that opens via the button)

If e.g. the quantity or value to be indicated in the authorisation must be provided as additional information about attachment, provide it or both here.

Read more about the restrictions guidelines:

If the import declaration must contain information on restrictions on greenhouse gas-depleting substances (F-gas) or ozone-depleting substances (ODS), read the instructions for providing additional information on restrictions.

Transport documents

Type: Here you can provide e.g. the details of the consignment note related to the goods item.

Reference: If you provided e.g. the consignment note related to the goods item in the field “Type”, provide its reference number here.

Additional references

The field has been filled in based on your earlier choices.

Container

The container details can be provided either at header level under “Declaration header” or at goods item level here. So if the goods are in a container and you have not provided the container details at declaration header level, provide the container details here. If the goods are in a container when you are lodging the declaration, provide the identification numbers for a sea container, swap body, semi-trailer or an air transport intermodal container. The identification of a sea container is provided using four letters + six digits + hyphen + check digit.

If you are lodging a supplementary declaration, you can only change container details if the declaration is a supplementary declaration for a period.

Quantity information of the goods

Provide here the required quantity information of the goods. Read the detailed guidance below.

Gross mass

If you can’t provide gross mass separately for each goods item here, provide the gross mass at declaration header level under “Declaration header”. If you are lodging a supplementary recapitulative declaration, you must provide the details at goods item level.

The gross mass is the weight of the goods including packaging, without the means of transport or containers. Enter the gross mass in kilograms. If the gross mass is below 1 kg, enter the value e.g. in the format “0,654”, but with no more than 6 decimals. If it exceeds 1 kg, you can round it off to the closest full kilogram.

Providing the weight of pallets: If the weight of pallets is included in the weight of the goods indicated in the transport documents, you can include it in the total gross mass. However, if the weight of the pallets has been indicated separately in the transport document, don’t include it in the total gross mass.

Net mass

Net mass is the actual weight of the goods without any packaging. If you are lodging a supplementary periodic declaration, provide the net mass of the goods that arrived during the period.

Supplementary units

If the TARIC nomenclature requires a supplementary unit for the commodity code, it will be displayed in the service. Enter the supplementary unit under “Quantity”. For example, many commodity codes for clothes require “piece” (NAR) as supplementary unit.

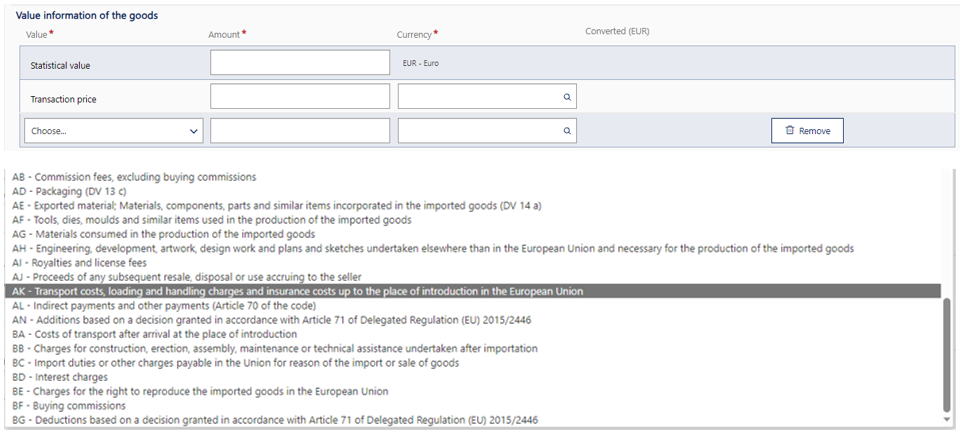

Value information of the goods

The value information provided at goods item level includes statistical value, transaction price as well as items to be added to or deducted from the transaction price that affect the customs value or the taxable amount for VAT. Items to be added can be e.g. freight and insurance costs.

The service automatically asks for the statistical value and te transaction price. If you wish to provide items to be added to or deducted from the transaction price, add a row by clicking on “+ Add”. The select from the drop-down menu, the item to be added or deducted.

Read the detailed guidance below.

Statistical value

Provide the statistical value of the goods in euros. Statistical value refers to the value of the goods on their arrival in Finland. It includes the actual or, if needed, the calculated transport and insurance costs as well as, if needed, the free deliveries not included in the price. The statistical value must be provided, even if nothing has been paid for the goods.

Transaction price

As the transaction price, provide the price paid or payable for the goods. Provide the transaction price with two decimals in the currency indicated in the invoice.

If you can’t provide the goods item-specific transaction price, provide the transaction price at declaration header level in the section “Declaration header”. If you are lodging a supplementary recapitulative declaration, you must provide the transaction price at goods item level.

Please note that here are separate instructions on how to declare free-of-charge consignments and removal goods.

Read more about declaring free-of-charge goods.

Read our guidance for individuals on how to declare removal goods.

Items to be added to or deducted from the value of the goods

If some costs need to be added to or deducted from the price paid or payable for the goods in order to determine the customs value or the taxable amount for VAT, click on “+ Add”. A new value row will be displayed, where you can enter the cost details. Read more about the determination of the customs value on the Finnish Customs website.

From the drop-down menu, select the code of the item to be added or deducted.

The value types beginning with the letter A are items to be added to the customs value. The value types beginning with the letter B are items to be deducted from the customs value. The codes “1A – Total to be added“ and “2A – Total to be deducted“ can only be used, if the value of the goods is less than 20 000 euros and no customs duty is levied on the goods.

If you are a private individual or a customer not registered for VAT, select the appropriate items to be added to the taxable amount for VAT, beginning with the number 3, and the service will automatically include them in the taxable amout for VAT. For example, the costs for freight not included in the customs value is provided with the code “3A – Transport, loading, unloading, insurance as well as other costs related to the import up to the first place of destination in Finland specified in the transport contract.”

The code “80 – Exceptional taxable amount for VAT” is only used in certain exceptional circumstances defined by the Tax Administration, for example when you use the customs procedure code 6122. If customs duty is levied for the imported goods, the amount of duty due must be added to the taxable amount for VAT. If you use the code “80 – Exceptional taxable amount for VAT”, you must add the duties due to the taxable amount for VAT. Read more in Read more in the Tax Administration’s instructions on the taxable amount for VAT (in Finnish).

If you are registered for VAT, you must provide the VAT details and the taxable amount for VAT in the Tax Administration’s MyTax service. In that case, the details that only affect the levy of VAT need not be provided in the customs declaration.

Read the separate instructions on the values for outward processing on the Customs website.

Currency

Provide the currency codes for the transaction price as well as for any costs to be added or deducted.

If the currency you need can’t be found in the drop down menu, you need to request the currency conversion rate from the Customs Information. You should convert the transaction price into euros using the currency conversion rate that you received from Customs. Enter the transaction price in euros. In addition, at goods item level, provide the currency conversion rate that you received with additional information code “FIKUR” and enter as the description the received conversion rate and the currency code (i.e. “19.14 MDL”).

Valuation method

Select the valuation method from the drop-down menu.

Select code 1 if the customs value is based on the price paid or payable for the goods when they are sold for export to the customs territory of the EU. If the valuation is based on a purchase or sale, i.e. if the nature of transaction is “11 – Outright purchase/sale”, select the code “1 – Transaction value of the imported goods” as the valuation method. If the nature of transaction is not purchase or sale (not the code 11) and the valuation is based on something else than the transaction value of the imported goods, select another valuation method.

Valuation indicators

When the customs value exceeds 20 000 euros, you pay customs duty and the import is commercial, provide the valuation indicators on the basis of the questions. If the buyer and seller are not related, answer the first question by selecting the option button “No”. Then you can proceed with the declaration. If the buyer and seller are related, answer the first question by selecting the option button ”Yes” and answer the questions that follow.

Preference and quota

Select the appropriate preference code from the menu. If you are not applying for a preferential tariff treatment, select “100 – Tariff arrangement erga omnes” as the preference code.

Fill in the field “Quota order number” only if you are applying for a quota benefit managed through EU tariff quotas, i.e. a reduced duty rate or duty relief. Russian lumber duty quotas are not provided here.

Tax bases

If the goods require a separate tax calculation quantity or quota quantity based on the commodity code, provide the quantity and unit hereProvide the tax base value in the field “Calculation of taxes – tax base”. Provide the currency in the field “Calculation of taxes – tax base unit”.

.png/c4ab6e05-b2db-3a88-c5e0-6b23bf34887e?t=1667908910456)

Additional references of documents and certificates

Under “Additional references”, the service automatically completes the reference on the basis of your earlier selections, if the goods were sent from outside the EU and may be subject to restrictions.

Proceeding from the goods item details

When you have entered all the details of the goods item, you can add another goods item by clicking on “+Add goods item” at the bottom of the page.

If you aren’t going to add any goods items, you can view the summary of the declaration you have filled in. Click on “Next” to proceed to the section “Summary and submission”.